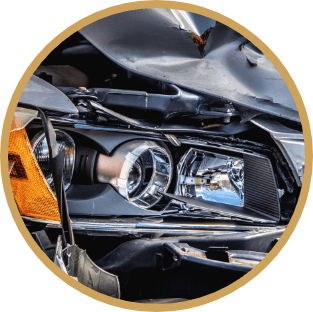

Personal Injury Attorneys Serving The St. Petersburg Area

Insurance Claims: Attorney Answers Your Questions

Insurance Claims: Attorney Answers Your Car Accident Questions

Open Phone: Insurance Attorney answers your car accident insurance questions.

Call directly: 727-619-2899 or 813-515-0889

Insurance claims denied? Insufficient coverage?

Do you have insurance-related questions about auto accidents, car crashes, denied insurance claims, insufficient policy coverages, damage claiming, handling and reporting?

Attorney Marc Nussbaum will give you all the answers you might be looking for right over the phone.

No obligations for you and completely good will, so feel free to call.

Marc Nussbaum and staff will be answering your calls on Thursday Sep 6, starting at 12pm till 1pm. (9/06/2018 12:00 pm EST)

Below you will find the short list of actions we prepared for weather-related insurance claims, like hurricane, flooding, storms etc..

Hurricanes cause severe damage across Florida to both personal property, motor vehicles, and boats. As business and homeowners return to their properties to file claims for hurricane damage, REEDER & NUSSBAUM, P.A. has a list of suggestions to help you work through those claims with your insurance company:

1. DETERMINE YOUR INSURANCE COVERAGE. Get out your insurance policy and determine what coverages you have. If you don’t have a copy, request one immediately from your insurance company(s). If you can’t determine your coverages, CALL US

2. MITIGATE YOUR DAMAGES: It could take weeks after Hurricane Irma for the insurance company to review and confirm the damage to your property. Mitigate damages by tarping or boarding up any areas or otherwise taking reasonable steps to prevent further damage to your property. If the roof is damaged, place a tarp over it. If a window is broken, board it up. Your insurance policy requires you to “mitigate” your damage, meaning you have to take reasonable steps to prevent the property from sustaining further damage. If you need help making repairs, hire a licensed contractor in your area for those basic repair services. But do not make permanent repairs or throw out damaged items until the adjuster has inspected your property. They will need proof of the damage to approve your claim.

3. TAKE PHOTOGRAPHS and INVENTORY property that sustained any hurricane damage. Include item types, brands, age and cost. If you have Internet access, try and find the of a product of “like kind and quality.” Print out the pricing information or save the link. Keep all your receipts and documents as well as records of conversations with the insurance company. Make an itemized list of all the storm-related damage.

4. REPORT the claim within a reasonable time and WORK with your insurance company. Allow them to take the necessary steps to make things right. When they fail to do this, CALL US!. Do not allow your insurance company or anyone else to remove your items or attempt to make repairs or restorations until you know ALL of your rights and options.

5. DON’T SIGN ANYTHING-with anyone, unless you understand exactly what you are signing.

6. Unless you have an insurance policy that states you must use your insurers MANAGED REPAIR PROGRAM, you have the right to hire your own contractor.

7. DAMAGE ESTIMATE-get these from both your insurance company and an independent company. Compare the two and ask questions about the differences.

Our special phone numbers for Hurricane-related Insurance questions (click to call): 727-619-2899 and 813-515-0889

Our attorneys will answer all your questions regarding auto accidents, your insurance coverage, hurricane damages, denied claims etc. Call!